Articles

Add Secure Income to your life

April 1, 2018

The markets are unsettling lately, should you worry about retirement planning?

You've had a lifetime of hard work, financial success and rewards. Your success has allowed you to do things you enjoy for yourself and your family and friends. You don't want that to change.

Three things you may be asking yourself:

- Am I uncomfortable depending on the stock market returns to maintain my lifestyle when I retire?

- Will my assets allow me to replace the income I had during my working years?

- Would I like having a predictable guaranteed lifetime income to allow me to continue the rich and rewarding life that I desire?

Work produces income; in retirement, you still need an income

If you are close to retirement then you have probably done some planning. You need to replace the income you had while working once you retire. You have your pool of investments, most of which you can easily access. You may have other investments that are less liquid and may take time to become sources of income.

The good news is you've amassed a lot of assets; however, stocks and other investments change in value. The bull market has gone on for a long time and it may continue. However, at some point, the tide will turn; a recession or an exogenous event can derail a bull market. When this happens, you will have less funds to draw on for income. In a down market, this can be risky.

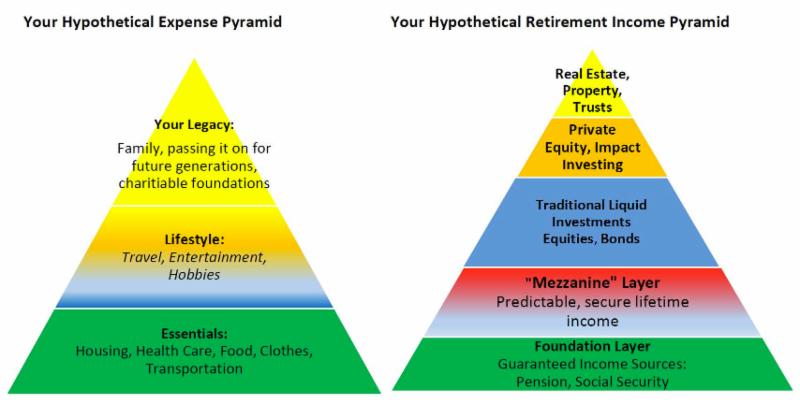

The pyramids of income and expenses

Think of your potential sources of income like a food pyramid where that bottom layer is your daily must have foods. In this case, it is your most secure income source, your foundation layer, with your pension and/or social security.

Your additional layers are the assets you may draw down to support your lifestyle and legacy plans. The value of these layers is subject to all kinds of risks such as stock market volatility and interest rate risk. These assets will go up and down in value as conditions change.

On the expense side, your expense pyramid has your essentials at its base. The next level is the fun, and the top level is the hopes for your family and legacy planning.

Does your foundation income layer cover all your expense layers? Unlikely. Those upper layers of income sources and investments are subject to all kinds of risks. Drawing on those assets at the wrong time could derail your plans.

Reduce risk, add certainty: the mezzanine layer

You can add a layer to your income pyramid that would not be affected by the volatility of the stock market or the challenge that bonds have maintaining value with rising interest rates.

We call this layer the mezzanine.

- Reduces your dependence on stock market returns and reduce your overall risk in your portfolio to maintain your lifestyle.

- Produces a lifetime stream of predictable income.

- Allows you to invest your other assets for longer term growth for your legacy and family.

- Provides peace of mind knowing that there is more secure income for your lifetime

Michael Kaleel, CLU, ChFC

President

Financial success today requires complex problem solving to manage the risks you see, and those you don't.

Recognized in the financial industry as a leader and complex problem solver for uncommonly successful individuals, Michael Kaleel and his team of specialists use their intellectual capital to create sophisticated insurance and investment solutions.

info@kaleelcompany.com | www.kaleelcompany.com/

STAY CONNECTED